atc income tax india

Insertion of new section 270A. Dividend income Section 9.

80c Deduction Tax Deduction Under Section 80c And Tax Planning Taxguru

Insertion of new section 270a.

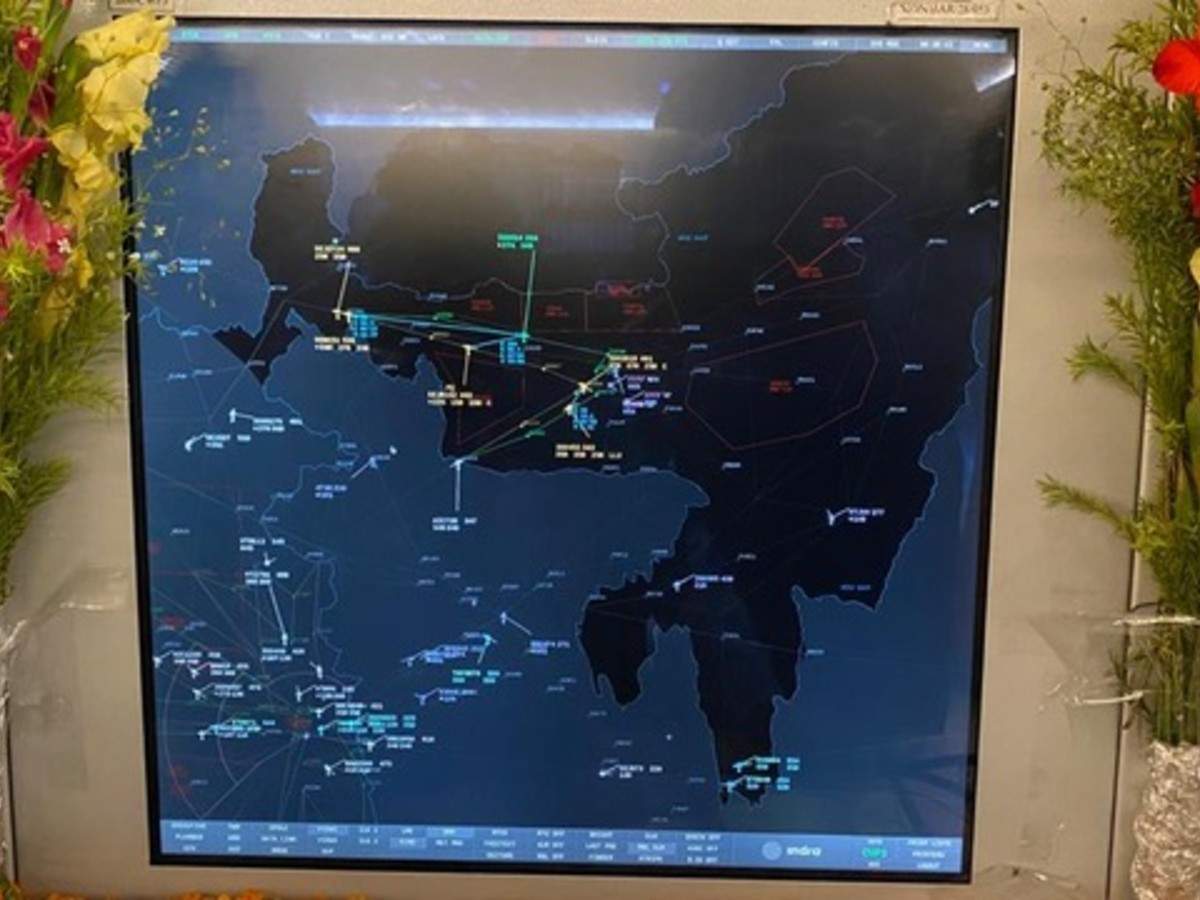

. This income tax exemption is allowed to HUF members as well as non-HUF members. Air Traffic Control is one of the most stressful jobs in the world. MUMBAI Feb 1 Reuters - India will impose a tax of 30 on income from cryptocurrencies and other digital assets finance minister Nirmala Sitharaman said while presenting the federal budget on.

Insertion of rule 16DD and form 56FF to the Income-tax Rules 1962. आज क इस आरटकल म म आपक आय कर अधनयम 1961 PDF Income Tax Act 1961 PDF download क हद व इगलश दन PDF उपलबध करन ज रह ह जनह. Here comes the real reward of being an ATC Officer in India.

Apportionment of income between spouses governed by Portuguese Civil Code Section 6. 21 This Act may be called the Income-tax Act. Income Tax Gratuity Social Security Schemes and Pension do remember all AAI employees get Pension after retirement.

Uncompromising professionalism and unfailing commitment to clients are biggest strengths of Acharje Tax Consultancy. Income deemed to accrue or arise in India. Charge of income-tax Section 5.

Find your nearest ATC Income Tax offices and make an appointment today. Us 80C you are able to reduce Rs1 50000 from your taxable income. Guidelines under clause 10D section 10 of the Income-tax Act 1961.

The national electric grid in india has an installed capacity of 393389 gw as of 31 december 2021. Employee Contribution Under Section 80CCD 1. After section 270 of the Income-tax Act as it stood immediately before its omission by section 105 of the Direct Tax Laws Amendment Act 1987 the following section shall be inserted with effect from the 1st day of April 2017 namely.

The Income Tax Department appeals to taxpayers NOT to respond to such e-mails and NOT to share information relating to their credit card bank and other financial accounts. For JE-ATC this can be approximately INR 8000 Income tax will be depending on how much. Scope of total income Section 5A.

A maximum of upto 10 of salary for employees or 20 of gross total income for self-employed individuals. Your appointment time will be set come and and immediately they will start working with you. The indian monthly tax calculator is updated for the 202122 assessment year.

Acharje Tax Consultancy helped us comply with the fast evolving company and income tax laws of this country very competently. Atc Income Tax India. INCOME-TAX ACT 1961 43 OF 1961 AS AMENDED BY FINANCE ACT 2008 An Act to consolidate and amend the law relating to income-tax and super-tax BE it enacted by Parliament in the Twelfth Year of the Republic of India as follows CHAPTER I PRELIMINARY Short title extent and commencement.

Section 80c of the income tax act of india is a clause that points to various expenditures and investments that are exempted from income tax. Residence in India Section 7. The maximum of Rs150000 can be asserted for the financial year 2016-17 2017-18 and 2018-19 each.

Public Notice regarding fraudulent appointment letter. Tia made me feel good filling my taxes I normally do them or line myself and was very undeceive about letting someone else file for me. Atc Academy Academy_atc Twitter.

May 10 2020 the income tax act brings to tax such liabilities which are no more payable. The Income Tax Department NEVER asks for your PIN numbers passwords or similar access information for credit cards banks or other financial accounts through e-mail. The limit is capped at 15 lakh aggregate of 80C 80CCC and 80CCD.

The amount of the advance - 200 to 500 - will be deducted from tax refunds and reduce the amount that is paid directly to the taxpayer. Tax deductions under Section 80CCD are categorised in three subsections. Section 80C of Income Tax Act is applicable only for individual taxpayers and Hindu Undivided Families.

If by chance you have paid taxes in excess and have invested in PPF LIC and. 42022 - Deduction of Tax at Source - Income-tax Deduction from Salaries under section 192 of the Income-tax Act 1961. Of such income-tax where the totalincome exceeds one crore rupees but does not exceed ten crore.

ATC is a premier tax preparation firm with a core focus in tax services. 4 THE GAZETTE OF INDIA EXTRAORDINARY P ART II c in the case of every domestic company except such domestic companywhose income is chargeable to tax under section 115BAA or section 115BAB of the Income-tax Act i at the rate of seven per cent. It allows for a maximum deduction of up to Rs15 lakh every year from an investors total taxable income.

1 500 Bonu also referred to as Free Tax Loan is an optional tax refund related loan not your tax refund and is via ATC Advance for qualified individuals Not EML. Reviews from ATC Income Tax employees about ATC Income Tax culture salaries benefits work-life balance management job security and more. 3 reviews of ATC Income Tax These star ratings should be a lot higher the service providers here are friendly fast and start forward.

Section 80C of the Income Tax Act of India is a clause that points to various expenditures and investments that are exempted from Income Tax. Income deemed to be received Section 8.

Income Tax Deductions List Fy 2020 21 Save Tax For Ay 2021 22

What Is The Income Tax Slab Rate For Ay 2020 21 Quora

Air Traffic Controller Salary In India Aai Atc Salary

Income Tax Return Filing A List Of I T Rules That Have Changed This Year

Checklist For Indian It Professionals Filing Individual Income Tax Returns Aotax Com

Incometax Twitter Search Twitter

Atc Income Tax Office In The City Tirupati

Income Tax Return Filing A List Of I T Rules That Have Changed This Year

Incometax Twitter Search Twitter

Atc Income Tax Reviews Photos Phone Number And Address Legal Services In Georgia Nicelocal Com

Air Traffic Controller Salary In India Aai Atc Salary

Safety Boost Aai Integrates Upper Airspace In Ne Region With Kolkata Atc Centre Times Of India

Atc Academy Academy Atc Twitter

Income Tax Tds Gst Filing Details With Reduced Penalty Tax Payer

Gowtham Co Tax Consultants Home Facebook

Telecom Tower Firm Atc Appoints Sanjay Goel As Chief Of Asia Pacific

Aai Acquires Eight Mobile Atc Towers For Small Airports Times Of India